AUSTRAC warns of criminal super risk

Finance authorities say Australia's $1.3 trillion superannuation pool could be used to fund terrorism.

Finance authorities say Australia's $1.3 trillion superannuation pool could be used to fund terrorism.

AUSTRAC - Australia’s financial intelligence authority – has reported on the results of a two-year study on “suspicious matter reports” (SMRs) among finance institutions including superannuation funds.

The review uncovered 19 reports related to potential terrorism funding, with transactions totalling almost $260,000.

But given that just five funds reported more than half of all SMRs, the experts say the problem could be even larger than it seems.

Overall, the research conducted with the Australian Federal Police, Australian Crime Commission and Australian Taxation Office over 2014 and 2015 found terrorism financing to be a small but looming threat.

“There is evidence foreign terrorist fighters have rolled over payments from APRA-regulated superannuation funds to SMSFs (self-managed superannuation funds), with the money ultimately being used for terrorism financing,” the AUSTRAC report noted.

“Fighters may also be supported by family or others in their community who are accessing their superannuation savings legitimately.”

The report also found superfund accounts could be abused by particularly patient criminals to launder proceeds of crime, allowing them to stash their money in the legitimate financial system and obtain low tax capital gains.

While the threat of terrorist exploitation is perhaps the most striking finding, the AUSTRAC report says that cybercrime and hacking remain by far the biggest criminal threat in superannuation.

About 85 per cent of all suspicious transactions, 249 in total, related to fraud or cybercrime.

“Hacking provides criminals with the data they need to breach the defences that superannuation providers have in place,” the report said.

“One large fund noted that cyber-enabled fraud attempts often started with small-scale attempts to find weaknesses in a fund's procedures and systems.

“Once a weakness was established, the fund was subject to ‘mass waves of attack’ from a number of fraudsters.”

The key vulnerabilities to breaches of money laundering and terrorist funding (ML/TF) laws include:

- The enormous number of member accounts and volume of transactions

- Low levels of member engagement, meaning fraud can take a long time to be detected

- Post-preservation accounts’ lack of restrictions on transactions

- Difficulty in identifying the source of voluntary contributions to accumulation accounts by members

- Vulnerabilities in payments to members and outgoing rollovers

- Strong reliance on online delivery of products and services

The report said the super system should strengthen itself.

“Given the size of superannuation holdings and the level of criminal activity in the sector, it is likely that all funds would be exposed to potential suspicious matters,” the report said.

“Low levels of reporting compared to industry peers may be an indicator of an ineffective [Anti-Money Laundering/Counter-Terrorism Financing] program.”

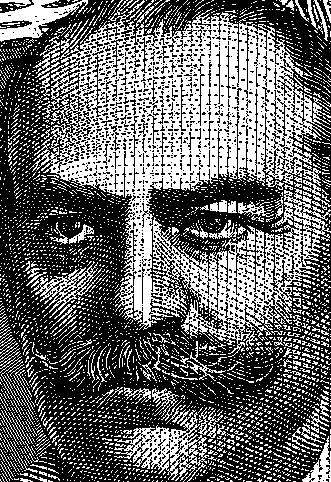

AUSTRAC chief executive Paul Jevtovic wants more suspicious matter reports.

“As with all regulated sectors, AUSTRAC will seek to engage funds that appear to have lower levels of compliance than their industry peers,” Mr Jetovic said.

“There is considerable scope for superannuation funds to expand their suspicious matter reporting and strengthen internal controls against financial crime.”

Print

Print