Hung issues predicted

Morgan Stanley says a hung parliament would have “meaningful” consequences for markets.

Morgan Stanley says a hung parliament would have “meaningful” consequences for markets.

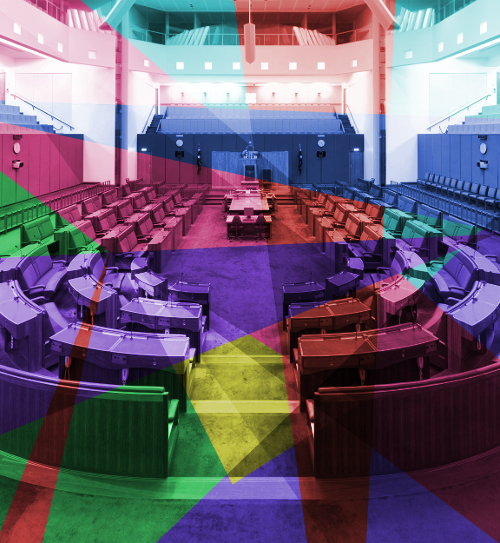

If the upcoming federal election results in a hung parliament for Australia, it would pose a material threat to Australian shares, analysts at Morgan Stanley warn.

They say it could potentially stall fiscal strategy at a critical juncture for the economy.

Morgan Stanley says that given the limited policy differences between the Coalition government and Labor’s campaign, the odds that neither major party will secure a majority in the 151-seat House of Representatives are growing.

“[The] risk of a hung parliament has risen for [May]’s election, and the consequences are meaningful for markets,” says Chris Nicol, Morgan Stanley’s head of Australian equity strategy.

“Minority government settings can lead to stalled and compromised fiscal intent and reaction, something not factored into growth or earnings outlooks, we would suspect.”

Markets have been boosted by record-breaking stimulus since the outbreak of the COVID-19 pandemic, but with both personal tax and business incentive measures facing “cliff-like” adjustments next year, things are predicted the change.

“As monetary policy is normalised and leaned into as the preferred tool to dampen inflationary risks, fiscal will play an important stabilising function,” Mr Nicol said.

“Scope and speed of fiscal reaction are always tempered by politics and ideological agendas, but this can be further curtailed and compromised should no mandate or majority be established.”

The growing support for independents could change both the scope and direction of fiscal policy.

“While independent candidates could support a government through supply without any specific policy concessions being given, the commentary from these candidates suggests that this would not be a preferred outcome for them,” Mr Nicol said.

“[This raises] the potential that a second poll would be required, and certainly increasing uncertainty in the immediate aftermath of the election.”

The local sharemarket tends to perform well around federal elections, but analysts at UBS say that because this election features fewer policy differences, the economic and market implications are less material.

Print

Print